Welcome to APLA Health

Financial Statement 2020

APLA Health is a careful steward of the gifts entrusted to us. We spend wisely to maximize our community impact, minimize overhead and prepare for the future and the needs of those we serve. We are grateful for your generosity.

For a complete copy of our financial statement, audited by BKD, LLP, please visit our Financials & Annual Reports page.

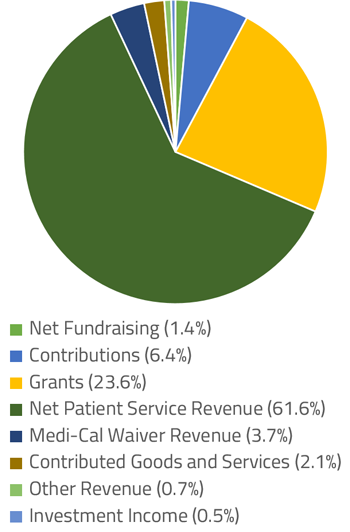

Revenue

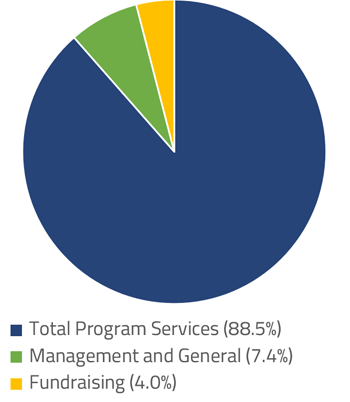

Expenses

| Consolidated Statement of Activities June 30, 2020 |

Consolidated Statement of Activities June 30, 2020 |

||||||

|---|---|---|---|---|---|---|---|

| 2020 | 2020 | 2019 | |||||

| Revenue & Support | Unrestricted | Temporarily Restricted | Total | Total | |||

| Net Fundraising | $853,526 | $853,526 | $996,258 | ||||

| Contributions | $2,144,263 | $1,713,528 | $3,857,791 | $4,336,726 | |||

| Grants | $14,291,978 | $14,291,978 | $14,029,514 | ||||

| Net Patient Service Revenue | $37,270,259 | $37,270,259 | $27,971,550 | ||||

| Medi-Cal Waiver Revenue | $2,226,382 | $2,226,382 | $1,972,490 | ||||

| Contributed Goods and Services | $1,293,096 | $1,293,096 | $1,549,812 | ||||

| Other Revenue | $360,466 | 75,635 | $436,101 | $570,619 | |||

| Investment Income | $87,770 | $186,107 | $273,877 | $285,309 | |||

| Net Assets Released from Restricted | $1,681,136 | ($1,681,136) | – | – | |||

| Total | $60,208,876 | $294,134 | $60,503,010 | $51,712,278 | |||

| 2020 | 2020 | 2019 | |||||

| Expenses | Unrestricted | Temporarily Restricted | Total | Total | |||

| Client Support | $6,128,369 | $6,128,369 | $5,136,274 | ||||

| Education | $5,969,331 | $5,969,331 | $6,982,991 | ||||

| Clinical Services | $36,657,099 | $36,657,099 | $27,071,222 | ||||

| Government Affairs | $572,326 | $572,326 | $509,958 | ||||

| Total Program Services | $49,327,125 | $49,327,125 | $39,700,445 | ||||

| Management and General | $4,143,889 | $4,143,889 | $3,596,882 | ||||

| Fundraising | $2,250,026 | $2,250,026 | $1,834,713 | ||||

| Total | $55,721,040 | $55,721,040 | $45,132,040 | ||||

| Change in Net Assets | $4,487,836 | $294,134 | $4,781,970 | $6,580,238 | |||

| Net Assets, Beginning of Year | $15,736,360 | $4,721,661 | $20,458,021 | $13,877,783 | |||

| Net Assets, End Of Year | $20,224,196 | $5,015,795 | $25,239,991 | $20,458,021 | |||

| Consolidated Statement of Financial Position June 30, 2020 |

Consolidated Statement of Financial Position June 30, 2020 |

||||||

|---|---|---|---|---|---|---|---|

| 2020 | 2020 | 2019 | |||||

| Assets | Unrestricted | Temporarily Restricted | Total | Total | |||

| Cash and Cash Equivalents | $10,032,284 | $940,178 | $10,972,462 | $9,084,699 | |||

| Investments | $507,499 | $507,499 | $2,379,909 | ||||

| Term Endowments | 2,617,480 | $2,617,480 | $2,571,269 | ||||

| Accounts Receivable, net | $5,906,615 | $5,906,615 | $3,762,154 | ||||

| Medi-Cal Waiver Receivable | $444,414 | $444,414 | $416,880 | ||||

| Grants Receivable | $2,865,700 | $2,865,700 | $2,180,460 | ||||

| Contributions Receivable | $155,501 | $644,050 | $799,551 | $1,125,659 | |||

| Prepaid Expenses & Other Accounts | $303,969 | $303,969 | $343,065 | ||||

| Deposits | $7,585,652 | 695,513 | $8,281,165 | $132,504 | |||

| Inventory | $244,111 | $244,111 | $201,971 | ||||

| Split Interest Agreements | $14,087 | $14,087 | $16,457 | ||||

| Property and Equipment (net) | $3,454,841 | 104,487 | $3,559,328 | $3,433,540 | |||

| Total Assets | $31,500,586 | $5,015,795 | $36,516,381 | $25,648,567 | |||

| 2020 | 2020 | 2019 | |||||

| Liabilities & Net Assets | Unrestricted | Temporarily Restricted | Total | Total | |||

| Current Liabilities | |||||||

| Accounts Payable | $3,001,333 | $3,001,333 | $2,331,762 | ||||

| Accrued Expenses | $2,087,989 | $2,087,989 | $1,479,316 | ||||

| Deferred Revenue | $1,327,578 | $1,327,578 | $969,978 | ||||

| Notes Payable | $4,859,490 | $4,859,490 | $409,490 | ||||

| Total Liabilities | $11,276,390 | $11,276,390 | $5,190,546 | ||||

| Net Assets | |||||||

| Unrestricted | |||||||

| Undesignated | $13,350,404 | $13,350,404 | $11,339,458 | ||||

| Board Designated | $6,873,792 | $6,873,792 | $4,396,902 | ||||

| Temporarily Restricted | $5,015,795 | $5,015,795 | $4,721,661 | ||||

| Total Net Assets | $20,224,196 | $5,015,795 | $25,239,991 | $20,458,021 | |||

| Total Liabilities & Assets | $31,500,586 | $5,015,795 | $36,516,381 | $25,648,567 | |||

Independent Auditor’s Report

Board of Directors

APLA Health & Wellness and The Global Forum on MSM & HIV (MSMGF)

Los Angeles, California

We have audited the accompanying consolidated financial statements of APLA Health & Wellness and The Global Forum on MSM & HIV (MSMGF) (the “Organization”), which comprise the consolidated statement of financial position as of June 30, 2020, and the related consolidated statements of activities, functional expenses, and cash flows for the year then ended, and the related notes to the consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with the accounting principles generally accepted in the United States of America; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatements, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated financial statements based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the Organization’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Organization’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the consolidated financial statements referred to above present fairly, in all respects, the financial position of APLA Health & Wellness and The Global Forum on MSM & HIV (MSMGF) as of June 30, 2020, and the changes in its net assets and its cash flow for the year then ended in accordance with accounting principles generally accepted in the United States of America.

Emphasis of Matters

As discussed in Note 24 to the consolidated financial statements, in 2020, the Organization adopted Accounting Standards Update (ASU) 2018-08, Not-For-Profit Entities (Topic 958): Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made and ASU 2016-01, Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities. Our opinion is not modified with respect to these matters.

Other Information

Our audit was conducted for the purpose of forming an opinion on the consolidated financial statements as a whole. The consolidating schedules, as listed in the table of contents, are presented for purposes of additional analysis and are not a required part of the consolidated financial statements. Such information has not been subjected to the auditing procedures applied in the audits of the consolidated financial statements, and accordingly, we do not express an opinion or provide any assurance on it.

Report on Summarized Comparative Information

We have previously audited the June 30, 2019, consolidated financial statements, and we expressed an unmodified audit opinion on those audited consolidated financial statements in our report dated November 11, 2019. In our opinion, the summarized comparative information presented herein as of and for the year ended June 30, 2019, is consistent, in all material respects, with the audited consolidated financial statements from which it has been derived.

Springfield, Missouri

November 25, 2020